Alternative Equity

Problem: Appraisal Gap

Through expert guidance, we've developed a strategic approach to using our Capital Fund to close the equity gap caused by low appraisals—without adding debt to the developer. The capital is returned within five years and reinvested into the next community project, creating a sustainable cycle of impact-driven development.

Case study below explaining how our program investments often work:

-

These costs vary per project, and include the purchase price and all costs associated with turning a property into a safe and affordable rental.

-

Independent real estate appraisals are assessments of a property's value and conducted on all of our funded developments.

-

Loans are typically done at 75% of the appraisal done after the renovations are completed. This is where we see the “Appraisal Gap”. ($205k x 75% = $155k)

-

If the developer used $190k for the development, and the appraisal is too low to cover the loan, but their debt service coverage ratio (DSCR) is high enough, we then use our “Alternative Equity” to get the deal done.

-

When the appraisal is lower than the investment required to rehab a property. This happens often in formerly red-lined neighborhoods and limits the ability for residents to invest.

Solution: Alternative Equity

We partnered with Cinnaire, a housing-focused CDFI, to connect local developers with development lines of credit for purchasing and rehabbing properties into affordable homes. They can use that line of credit to complete their development.

While the initial investment is critical, we encountered the common challenge of appraisal gap for the long-term financing. Through innovative collaboration with the City of South Bend, Notre Dame Federal Credit Union, and other local funders, we developed a solution we call "Alternative Equity"—a method that fills the equity gap and closes permanent financing for properties to not overburden developers.

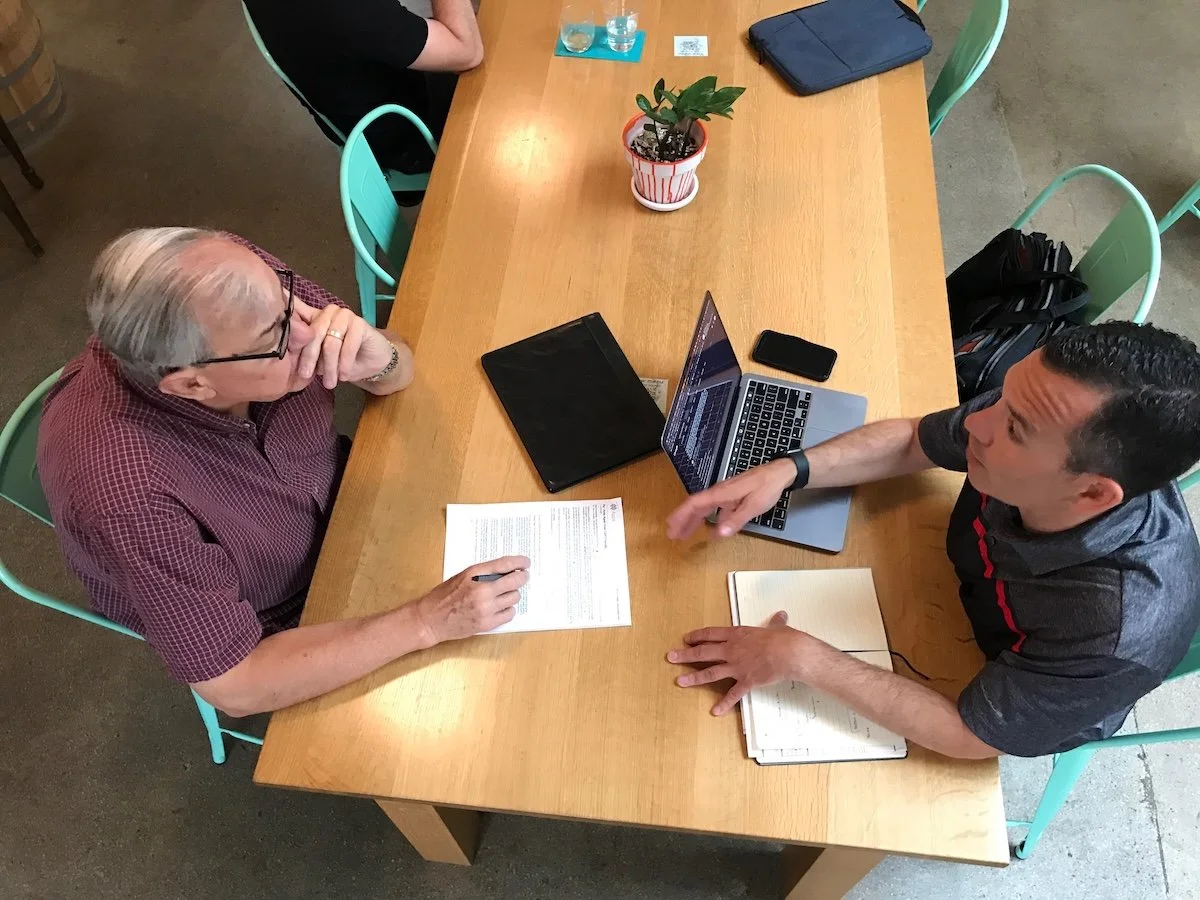

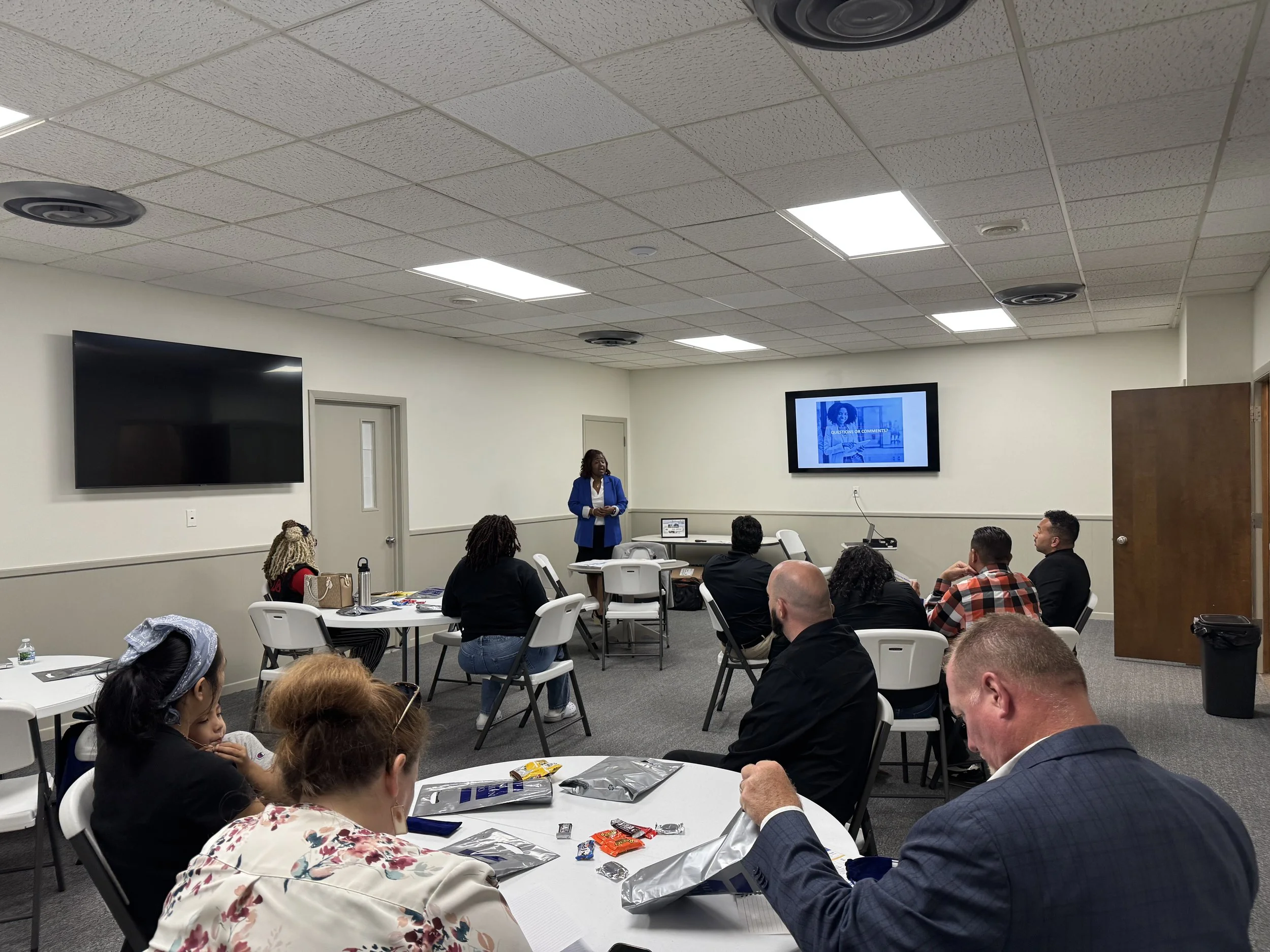

Jerry Langley, retired University of Notre Dame professor and NDFCU Board Member who helped design the details of the program, meets with CDFI Friendly Director Sam Centellas.Through advocacy and focus on community needs we have brought stakeholders together to create change in our region. This innovative program is an example of how we can create and fund products to meet needs.

-

10

Funded Community Developments

-

23

Improved Units of Affordable Housing

-

$280k

Current Capital

Fund Utilization -

$1.67M

Total Neighborhood Investment Created